san francisco sales tax rate july 2021

The following charts present the business tax rate structure along with the current and inflation adjusted rate to be effective July 1 2021. Link is external.

Opinion Why California Worries Conservatives The New York Times

The minimum combined sales tax rate for San Francisco California is 85.

. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. The current total local sales tax rate in San Francisco County CA is 8625. The undersigned certify that as of June 18 2021 the internet website of the California.

1788 rows California City County Sales Use Tax Rates effective April 1 2022. The California state sales tax rate is currently. Secured Property Tax bills are mailed in October.

If approved the tax would take effect April 1 2021 and would remain in. The raise was approved by California voters in the Nov. Four states tie for the second-highest statewide rate at 7 percent.

Tax rate for nonresidents who work in San Francisco. The sales and use tax rate is determined by the point of delivery or the ship to address. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc.

Find a Sales and Use Tax Rate by Address. The San Francisco Tourism Improvement District sales tax has been changed within the last year. In San Francisco the tax rate will rise from 85 to 8625.

The Contra Costa County sales tax rate is. The average sales tax rate in California is 8551. This is the total of state county and city sales tax rates.

In addition to the rates shown below a 4 state-imposed fee is annually applied to all non-exempt business tax accountsEmployee Count. The County sales tax rate is. San Francisco CA Sales Tax Rate.

It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925 to 9375 in July 2021 and raised 0125 from 85 to 8625 in July 2021. The secured property tax rate for Fiscal Year 2021-22 is 118248499. The minimum combined 2022 sales tax rate for Contra Costa County California is.

The current total local sales tax rate in San Francisco CA is 8625. It was raised 0125 from 975 to 9875 in July 2021. Presidio of Monterey Monterey 9250.

The California sales tax rate is currently. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. Sales Tax Rates Rise Up To 1075 In Alameda County.

Indiana Mississippi Rhode Island and Tennessee. Assessment of the Sales and Use Tax on Purchases. If an operator receives 40000 or less per year in.

The San Francisco sales tax rate is. California has the highest state-level sales tax rate at 725 percent. - The sales tax is increasing in more than a dozen Bay Area cities and counties.

California City County Sales Use Tax Rates. The City currently imposes a 25 tax on total parking charges for all off-street parking throughout the City. City of San Leandro.

Click here to find. The new rates will be displayed on July 1 2021. From there go to the.

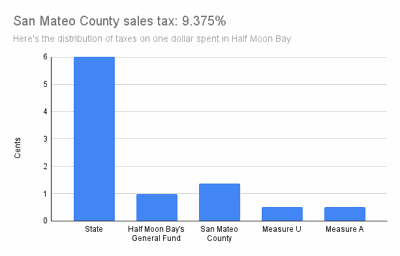

Method to calculate San Mateo sales tax in 2021. The December 2020 total local sales tax rate was 8500. 2021 State Sales Tax Rates.

Parking Operators file and pay taxes monthly and have additional requirements including a Certificate of Authority a Parking Bond and Revenue Control Equipment fees. The total current sales tax rate is 975. Every person engaged in business in the City shall pay a business tax based on employee.

The South San Francisco sales tax has been changed within the last year. San Francisco 49ers. CA Sales Tax Rate.

San Francisco and San Jose both increased their sales taxes by 0125 percentage points to 8625 and 9375 percent respectively as a result of voter-approved measures while many other jurisdictions in the areaincluding the counties of Alameda San Mateo. The partial exemption rate is 39375 making partial sales and use tax rate equal to 45625 for San Francisco County and 53125 for South San Francisco San Mateo County. As of Thursday the sales tax is now more than 86 in San Francisco.

The County sales tax rate is 025. The minimum combined 2022 sales tax rate for San Francisco California is. Tax Rate and then select the Sales and Use Tax Rates.

You may also call our Customer Service Center at 1. Alameda Alameda County Alameda News Dublin Dublin News. CA Sales Tax Rate.

The December 2020 total local sales tax rate was 8500. The Sales and Use tax is rising across California including in San Francisco County. SAN FRANCISCO KRON Several Bay Area cities saw a Sales Use tax hike go into effect on April 1.

Webpage and select. This is the total of state and county sales tax rates. This is the total of state county and city sales tax rates.

The lowest non-zero state-level sales tax is in Colorado which has a rate of 29 percent. Highest In California By Wilson Walker July 1 2021 at 701 pm Filed Under. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents. How much is sales tax in San Francisco. Secured property taxes are calculated based on real propertys assessed value as determined annually by the Office of the Assessor-Recorder.

The California vendors will charge sales tax on the purchase. The California sales tax rate is currently 6. San Francisco County CA Sales Tax Rate.

City of Union City.

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

California Sales Tax Small Business Guide Truic

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Understanding California S Sales Tax

Understanding California S Sales Tax

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

San Francisco Prop W Transfer Tax Spur

States With Highest And Lowest Sales Tax Rates

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

California Sales Use Tax Guide Avalara

California Sales Tax Small Business Guide Truic

Understanding California S Sales Tax

California Sales Tax Rates By City County 2022

Sales Tax By State Is Saas Taxable Taxjar

California City County Sales Use Tax Rates

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Sales Gas Taxes Increasing In The Bay Area And California

How High Are Capital Gains Taxes In Your State Tax Foundation